A publication of the Indiana Business Research Center at Indiana University’s Kelley School of Business.

Independent Voters of Brown County IN

Working towards "a more perfect Union," county, and community

County Council Meeting – Budget, Oct 24, 2022

Oct 24, 2022. County Council Budget Approval. The Council approved the proposed budget that is due by Nov 1, 2022. The Department of Local Government Finance (DLGF) reviews, makes any needed adjustments and then approves. The final budget is published in Jan

Premium Pay – ARPA Funded. The commissioners and council had previously approved premium pay of $2.00 an hour over a three-year period (about 12K total). There are 47 Employees who are receiving the premium pay and 135 who did not. The ones who received premium pay were those who were continuously exposed throughout Covid, (what is being referred to as boots on the ground). Given accounting issues, this option will need to be “re-structured” to include all employees and will exclude elected officials.

Councilmen and Commissioners also received a $1,000 payment funded from a different appropriation.

Request for information (RFI). I have asked for the auditable accounting reports associated with the ARPA funds/premium pay and Health Insurance budgeted and actual costs.

Part 2: Trails, Parks, Culture, Brown County, IN

Updated: Oct 24, 2022

Updated: Oct 24, 2022

Part 1: Part 1: Trails and Parks, Brown County IN

What is Brown County’s “One Thing”?

The One Thing – The Secret of Life – City Slickers

-

- Curly: Do you know what the secret of life is? Mitch: no what?

- Curly: This ( he holds up 1 finger) Mitch: Your finger?

- Curly: One thing. Just one thing. You stick to that and everything else don’t mean s**t. Mitch: That’s great but, what’s the one thing?

- Curly: That’s what you’ve got to figure out.

“The One Thing” – Quality of Life? – Brown County is the most heavily forested county in the state. It includes hills, natural beauty – especially in the fall, two-lane roads, and only three stoplights. Our Quality of Life contributes to what attracts new residents and retains the old. It also attracts artists and visitors (tourists). The”One Thing:”

-

- Nashville? “… Nashville has identified its intent to be a “driver” of regional tourism.

- Brown County – Quality of Life?

- Most heavily forested county in the State, with beautiful scenery. Access to hundreds of miles of public trails (biking and hiking) within the county.

- Described as a “Bedroom Community” where residents choose to live here and retire here and where income is generated outside the county.

- Within a relatively short distance to larger communities (Columbus, Bloomington, Indianapolis) that offer amenities not available locally.

- Trends. Among the lowest property taxes in the State contribute to a demand for land, homes, and commercial property which has led to an overall higher cost of living making the county unaffordable for many. A county income survey in 2016 identified that 53.1% of residents fall within the low to moderate income level.

- There has been a downward trend in the number of residents reporting income under $50,000 and an upward trend in the number of residents reporting income over $50,000. Overall, a downward trend in the number of residents filing returns.

- County Income Trends – State Tax Returns – 1999-2018

- County Population Projections

The vision for what county residents want and do not want should be captured in the County Comprehensive Plan that drives zoning and budgets. Zoning identifies the type of development desired that will be supported by residents (tax base.) The tax base supports budgets.

-

- In the case of Trails and Parks, the Convention Visitors Bureau (CVB) helps market these features to “tourists.”

Future updates to the Comprehensive Plan can be submitted by areas to accommodate any unique requirements. Areas could include: Nashville, Helmsburg, Bean Blossom, Lake Lemon, Cordrey/Sweetwater, Stone Head, etc. A “hamlet” supported plan was developed (not approved) in 1993. The default is a current 12-page plan that is purposely vague to allow almost any type of development.

Economics

-

- The county is funded primarily by income and property taxes. Tourism brings in about $12.1 million in taxable wages and $22.6 million in economic impact. The total taxable income from all residents – many if not most of whom derive their income from outside the county accounts for over $425 million in taxable income that is also used to pay property taxes. Non-residents who own second homes also contribute to residential property taxes albeit at a higher rate. (Ref: Brown County’s Economic Engine?)

-

-

-

Brown County’s Economic Engine? Excerpts – Andy Rogers:

- People say, ‘Well, we can’t change.’ But we can change and still retain some of the flavor of Brown County. We need people to live here. I’m in the tourist business but we don’t want to turn this town over to the tourists. You can go to Gatlinburg if you want to see what happens to a town that turns it all over to business. It’s not a town anymore—it’s a shopping center. We need people here. This town needs to be alive.”

- “We don’t need to be slick and highly commercial. We need to be more country. Country is what we sell…. We need to maintain that. Once you destroy that, it won’t come back.”

- Andy Rogers: Vision for Brown County and Nashville: “He stands at the center of Nashville’s dogged attempt to satisfy a tourist industry while retaining its soul—the thing that people have lost in their own communities, the reason they come to visit in the first place.”

-

-

Tourism commercial interests can dominate the narrative. The Convention Vistors Commission (CVC) – members appointed by commissioners and the council, oversee the revenue from the innkeeper’s tax (over a million a year). The County Council by law is responsible for reviewing and approving the CVC budget.

This revenue from the innkeepers’s tax can be spent on “anything” that promotes tourism. This included trails, parks, preservation, education, recreation, et.al.

The CVC contracts with the Convention Visitors Bureau (CVB) to spend the revenue from the innkeeper’s tax on promotions, salaries and benefits, visitors center, etc.

Commissioner Meeting Notes: Oct 19, 2022

Commissioner Meeting Notes: Oct 19, 2022. 2:00 p.m.

Road Paving Plan. The plan going out to 2026 was briefed at the last commissioner’s meeting. It has yet to be posted to the Highway Departments Website.

https://www.browncounty-in.gov/262/Road-Improvement-Plan

Health Insurance Benefits and Costs. I have asked the auditor for information regarding what has been budgeted at the beginning of the year, and what the actual costs have been. The auditor maintains the auditable information needed to track the trends on costs.

State and County Budgeting Process. The budgeting process is “fluid.” In order to submit a “balanced budget” to the state and to maintain the balance throughout the year, the State underestimates revenue projections and the county underestimates expense projections. A standard practice.

Without transparency, money management can resemble a three-card monte game. This “fluid” process undermines integrity and transparency. As a local supplement to the budget, it would be helpful if the county “identified” the underestimated expenses (unfunded requirements). For example, health insurance costs over the past few years have been underestimated by over 500K. The county can also review the trend on what the state estimated in revenue and what we actually received. This too would be helpful information and help keep the public informed on the process and status of the budget.

Health Insurance Eligibility. Includes: Permanent part-time employees, employees working 20 hours or more, and elected officials – full and part-time. Commissioners and council are part-time.

Employee Compensation. Melissa Stinson who has accepted a government job in Monroe County reinforced that county employees may be making less than their counterparts in surrounding counties that have larger budgets, but the county does have generous benefits (time off, health insurance, working conditions) that help even out the disparities. Keith Baker on the council at the time conducted a salary and benefit study in 2018 that identified that the Brown County benefit package was the best of the counties surveyed

Commissioner Meeting Notes: Oct 19, 2022. 2:00 p.m.

Road Paving Plan. The plan going out to 2026 was briefed at the last commissioner’s meeting. It has yet to be posted to the Highway Departments Website.

https://www.browncounty-in.gov/262/Road-Improvement-Plan

Health Insurance Benefits and Costs. I have asked the auditor for information regarding what has been budgeted at the beginning of the year, and what the actual costs have been. The auditor maintains the auditable information needed to track the trends on costs.

State and County Budgeting Process. The budgeting process is “fluid.” In order to submit a “balanced budget” to the state and to maintain the balance throughout the year, the State underestimates revenue projections and the county underestimates expense projections. A standard practice.

Without transparency, money management can resemble a three-card monte game. This “fluid” process undermines integrity and transparency. As a local supplement to the budget, it would be helpful if the county “identified” the underestimated expenses (unfunded requirements). For example, health insurance costs over the past few years have been underestimated by over 500K. The county can also review the trend on what the state estimated in revenue and what we actually received. This too would be helpful information and help keep the public informed on the process and status of the budget.

Health Insurance Eligibility. Includes: Permanent part-time employees, employees working 20 hours or more, and elected officials – full and part-time. Commissioners and council are part-time.

Employee Compensation. Melissa Stinson who has accepted a government job in Monroe County reinforced that county employees may be making less than their counterparts in surrounding counties that have larger budgets, but the county does have generous benefits (time off, health insurance, working conditions) that help even out the disparities. Keith Baker on the council at the time conducted a salary and benefit study in 2018 that identified that the Brown County benefit package was the best of the counties our size that were surveyed. https://independentvotersofbrowncountyin.com/2019/07/18/2018-staffing-study/

Health Department Building Remodel. This remodel includes a new public bathroom, break area, and clinic space. Cost estimated at 75-100K. The county purchased this building from the Town at a cost of 400K. The town identified expenses needed for ADA compliance and the county has also made other changes. At the time of the unanimous decision to purchase this property, the costs of needed changes were not identified. Further, the county does not publish an asset management (capital improvement) plan to manage infrastructure life-cycle costs. The council has identified that such a plan is on their to-do list.

https://independentvotersofbrowncountyin.com/2019/07/18/2018-staffing-study/

Health Department Building Remodel. This remodel includes a new public bathroom, break area, and clinic space. Cost estimated at 75-100K. The county purchased this building from the Town at a cost of 400K. The town identified expenses needed for ADA compliance and the county has also made other changes. At the time of the unanimous decision to purchase this property, the costs of needed changes were not identified. Further, the county does not publish an asset management (capital improvement) plan to manage infrastructure life-cycle costs. The council has identified that such a plan is on their to-do list.

Part 1: Trails and Parks, Brown County IN

Updated Feb 7, 2022

Over 50% of our land mass is state and federal-owned. This includes Brown County State Park which attracts over a million visitors a year. It also attracts and retains residents that value “country.” The “One Thing?: Part 2: Trails, Parks, Culture, Brown County, IN

-

- State land includes Brown County State Park, and Yellowood State Forest.

- And, residents can also opt to put forested land into a Classified Forest category that restricts development and reduces their property taxes.

- Federal Land includes Hoosier National Forest.

- The USDA also offers cash incentives for land use and conversation.

- Brown County also owns land.

- Private/ Non-Profits:

- Non-Profits include: Nature Conservancy, Sycamore Land Trust, and other non-profits that manage private land via a public organization (501c3) that allows access by the public such as Stone Head.

- State land includes Brown County State Park, and Yellowood State Forest.

I am not aware of a “master map,” website, or Facebook page (?) that provides a one-stop-shop for information on all our trails and parks (government, private/non-profits) that the public can access.

In promoting hiking opportunities, it also may be good that in addition to residents, identify other stakeholder groups – Hiking and Biking groups for example. The Knobstone/Tecumseh Trail has been recognized nationally.

More visibility about our Trails and Parks could help expand the narrative in the county that reinforces a focus on the Quality of Life in the county. Very few residents want to see Nashville/Brown County turn into a Gatlinburg-Light.

Inventory? A start – Master List of Public Trails. To do – develop an “inventory” of existing trails and hiking associations. Would also be good to develop a “digital (GIS) map.” For example – mountain bikers have trails that can be downloaded to a phone or another device.

Master List of Trails, Parks, and Preserves Open to the Public

Regional Visibility – Indiana Uplands – Brown County. Known as the “Art Colony of the Midwest,” Brown County and the town of Nashville have attracted visitors for generations with spectacular views of rolling hills and forested land. Today, this popular destination is known for award-winning schools, eclectic art studios, distinctive restaurants and shops, and endless outdoor activities. Experience natural beauty, warm hospitality, and adventure in Brown County.

Stakeholder Groups:

Private – Non-Profits

-

-

- The Laura Hare Nature Preserve at Downey Hill

- Trevlac Bluffs Nature Preserve

- Newsletter – The new trail at Sycamore’s Laura Hare Nature Preserve at Downey Hill in Brown County Twig_Winter16_web 2016 –

-

- Federal

-

- Hoosier National Forest – Charles C. Deem Wilderness. As Indiana’s only officially designated Wilderness Area, the Charles C Deam Wilderness is special by definition. Discover what Wilderness means and how you can do your part to keep up the area’s untrammeled spirits. Location: Monroe, Brown / Jackson / Lawrence counties, Indiana, USA Nearest city Bloomington, Indiana

State

-

- Department of Natural Resources (DNR) Indiana Trails Program

-

Gov. Holcomb Announces $65 million in Trails Grants for Communities Across Indiana

-

TRAILS INVENTORY INTERACTIVE MAP: Indiana has over 5,000 miles of trail and more than 95% of Hoosiers are within five miles of one! The Indiana Trails Finder interactive map has every trail the DNR is aware of in the state, including off-roading, paved, natural surface, mountain biking, and more! New trails are constantly being added too. View the Indiana Trails Finder at https://arcg.is/0yLHnr.

-

- Brown County State Park

-

Brown County State Park named one of the top 10 most beautiful state parks in America – WRTV

-

- Yellowwood State Forest

- Tulip Trace Trail – Hiker’s Path: Old trails, new trails and remnants of the past

- Mountain Tea State Forest

-

Tecumseh and Knobstone Trails and Maps

-

Current Status: Brown County – Part 3. Closure RR Xing at Indian Hill Rd that included pedestrian access to the Tecumseh Trail.

-

- New? Connector Trail (3+ miles) to the Brown County State Park trail system?

- Yellowwood State Forest

-

Indiana University

-

-

Explore the Lilly-Dickey Woods

- “That is not where our story starts, however. The Lilly-Dickey woods have been important to many people and its history is an integral part of Brown County lore. Lilly’s land was called “Hamblen Forest” after Jesse Hamblen, who settled in Brown County in 1825 and lent his name to nearby Hamblen Township.”

- “With Tuxhorn’s passing there was increased interest in the future of the Lilly-Dickey woods. In 2001 Indiana University established the Research and Teaching Preserve with the purpose of providing field-based formats for environmental research and experiential education.”

- “In 2003 the Lilly-Dickey woods were incorporated into the preserve. The pristine land provided a unique opportunity for research, and in 2009 it became a part of the Smithsonian Institute’s Center for Tropical Forest Science database that provides models for understanding carbon storage and regeneration dynamics. Such research is made possible by one factor—the advanced age of the forest.”

-

-

- The Indiana University Research and Teaching Preserve comprises nearly 1,600 acres.

-

THE GEOLOGIC STORY HILLS, RIDGES, AND RAVINES The Brown County landscape formed in the past few million years through the erosive power of streams and glacial meltwater on ancient deltaic rocks.

-

Other DNR – Division of Forestry High Conservation Value Forests (HCVF)

-

- Yellowwood Conservation Area

- “Back Country Area High Conservation Value Forest (HCVF) Proposal Morgan-Monroe

State Forest” IFA_HCVF_KHTA-Comment - Monroe / Brown. fo-MMSF-BCA

County

-

- How to Hike to Browning Mountain, Indiana’s Stonehenge – Engineer to Explore

- Salt Creek Trail – Phase I

- Deer Run Park

- County GIS Map – Search by Name, Entity, Organization

- For county-owned land – Search: “Brown County Board of Comm”, and “Brown County Parks and Rec”

- Can also search: Sycamore Land Trust, Indiana University, DNR, Department of Natural Resources, Nature Conservancy, United States of America,

- There is a “layer” for Hoosier National Forest

- Tecumseh Trail

- Backpacker Magazine The 50 Best Hikes in the U.S. – Indiana Tecumseh Trail. [Editor’s Note: Indiana’s Tecumseh Trail has been closed since May 2020 from State Road 45 to the parking area south of Beanblossom Creek. The trail is bisected by a railroad crossing. Hikers who cross the tracks or divert to an adjacent road will be trespassing. The Knobstone Hiking Trail Association is working on a solution to reopen the trail.

-

-

- OUTDOOR BRIEFS: Tecumseh Trail Challenge this weekend.DINO and Indiana Trail Running will host the Tecumseh Trail Challenge on Sunday, Oct. 23. The trail is located in Yellowwood State Forest, 772 S. Yellowwood Road.

-

-

- Kenneth Tuxhorm. Ken was founder and director of Outdoor Educational Activities Incorporated, a non-profit organization at Bear Wallow in Brown County for 64 years. He had a passion for nature and the outdoors, but he will be remembered mostly for helping young people become better citizens of this world.

Mountain Biking – Bike Packing addditional trails in addition to the trails in Brown County State Part

-

- The Brown County Delight. Set in Bloomington, Indiana, home of the classic cycling film “Breaking Away,” the Brown County Delight is a 2-3 day bike packing loop that follows challenging gravel roads, double track, and scenic singletrack directly into Brown County State Park. The route offers opportunities to further explore its well-regarded MTB trails and take advantage of the food and drink available in the area…

Other: Tourism

-

- Brown County Convention Visitors Bureau

- Information: Trails, Parks, Tourist Rentals, Camping, Private Resorts, Campgrounds, RV Parks, et.al.

- Brown County Convention Visitors Bureau

Other – Fed, State, Pvt

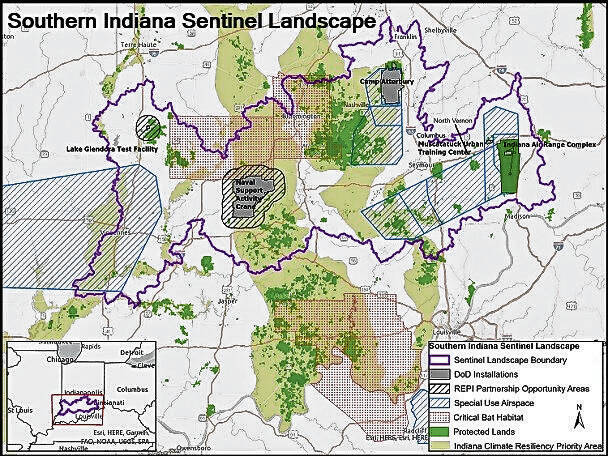

Feb 7, 2023. BC Democrat, Meeting to focus on new federal sentinel landscape area

Other – History.

County Council Meeting Notes Oct 17, 2022

Council Meeting Aqenda October 17, 2022

Admin Issues. Council reviewed needed changes to the salary ordinance and job descriptions. Job descriptions underwent a needed and thorough review. Changes included a review and update to the Human Resource Director position and a reduction in a pay grade. Other agenda items were routine (and adverstised) fund transfers between accounts.

Note: Job descriptions are linked to salaries and salaries to budget which is why the council is involved.

Budget: The next meeting to finalize the budget will be on Oct 24, 2022, 6:30 p.m at the Brown County Fairgrounds, Exhibit Hall 802 Memorial Drive. The 2022 projected year-end balances can be used to offset the estimated deficit for 2023. This along with other reductions expected to result in a budget that will be accepted by the State. Per Councilman Dave Redding, the 2023 Budget has been one of the toughest to balance in recent memory. Given the economy and inflation, balancing budgets may be a recurring challenge.

Vote NO “This year” on the school referendum?

Updated: Nov 18, 2022

The justification for a new referendum as opposed to taxpayers receiving a tax cut when the old referendum expires is based on a one-sided closing argument without supporting analysis and evidence of need.

The rationale for the referendum is followed by a marketing campaign and advocacy by surrogates. Attempting to justify the need after the decision has been made is not credible due to bias and compromises the integrity of the surrogates advocating for the new tax.

Nov 16, 2022. BCD. Superintendent offers thoughts after school referendum fails on ballot

-

- The “Spin” – justification based on “its not that much.” — “If the Brown County School’s referendum would have passed, the median assessed value homeowner would have paid roughly $3 to $6 more per month in property taxes.” ….”… the increase of 33% was not how much an individual would pay in property taxes, instead it was the increase in the tax rate.

- The correct (No Spin) calculation on the increase in taxes.

- Referendum-Auditor-Operating-Brown-County-School-Corporation: “The average property tax increase paid to the school corporation per year will increase by 33.91% for residences and 20.91% on business property.”

- Post of the Article at Brown County Mattes

History -Systemic Problem – Debt, budget shortfalls, declining enrollment, aging demographic

-

-

May 2017. Debt, Enrollment compound concerns for schools’ budget

- Sep 2018. SUPERINTENDENT’S CORNER: The importance of enrollment to our schools’ future

- The most important day, financially, for a school district is the Average Daily Membership Day, … the ADM Day determines tuition support funding for all public schools in Indiana. … The tuition support funding through what is called a “basic grant” is the primary source of revenue for the district’s general fund. The general fund is the fund that pays the salaries and benefits for almost all employees in the school district.

-

Nov 9, 2022. WTHR. ‘It felt like a death’ | Brown County voters reject school referendum. Brown County voters were asked to renew a referendum that they approved back in 2016, a $15.1 million referendum that expires next year.

-

- “What’s next for the school district? Tracy said they will seek another referendum in 2023, before the current one expires.”

Nov 3, 2022. Act of Desperation? The Facebook Post at Brown County Chatter by the superintendent. Also shared on Brown County Matters claims that amount of the tax increase is “misleading”.

-

- MISLEADING??? The exact language required by the state: “The average property tax increase paid to the school corporation per year will increase by 33.91% for residences and 20.91% on business property.” What is misleading and disrespectful is Ms. Tracy’s comment published in the Democrat that:” For the average home value in Brown County, this is an additional $3.26 per month, which is less than a McDonald’s Extra Value Meal.”Basing a justification of need because “it’s not that much” is absurd. “Vote No” which may lead to the school leadership to make a credible case on need where the taxpayers can draw their own conclusions regarding “it’s not that much.”

Note also that the referendum will transfer over $15 million dollars from the taxpayers to the school over 8 years. – Not exactly a trivial amount.

Summary

Bottom Line Up Front (BLUF). A “NO Vote This Year” may lead the new school board leadership to re-assess the need and scope and develop community-wide support. This could be followed by a defendable argument free of fallacies, to justify the need for additional revenue. (Ref: Critical thinking, arguments, fallacies, rhetoric).

A Recap. The first referendum was passed in 2016 and expires in 2023. The decision to pursue another referendum will generate over $15 million dollars over 8 years. The decision for a new referendum was first “introduced” to the public in the three information sessions on May 31, June 7, and June 14. These meetings were followed by a unanimous vote by the school board (July 14 ) to place the referendum on the ballot. This was then followed several weeks later by a website and marketing campaign including support from a political action committee (PAC).

-

- Other approved tax increases. Oct 13, 2021. SCHOOL NEWS: Board approves renovation projects at high school. In July 2021, the school board approved an 8 million dollar loan for infrastructure that sustained the tax rate (as opposed to reducing it) being paid by property owners.

Observations and Commentary

Lack of Analysis. There has been no comprehensive analysis documented in a published report that defends the decision for a new referendum. Such a report should include the justification of need as opposed to a “nice to have.” Such a report might also include an independent and objective analysis of the results of the revenue from the first referendum. This referendum was also marketed as supporting a need to increase teacher pay.

Analysis, Review, Scrutiny. A comprehensive analysis to justify a need would include a trend of performance to State and local goals and objectives, a mission analysis that identifies what must be accomplished and what is optional, an analysis of alternatives, an analysis of staff pay and increases, a review of revenue and expense trends from all sources, enrollment trends, trends of student-teacher ratios by a school and by grade, the capacity of our existing schools, and the criteria to be considered in the need to close a school. Also helpful would be comparisons with other schools.

McDonald’s Extra Value Meal? The justification by the superintendent has included a statement that the increase in taxes (4 cents) is only the equivalent of the additional cost of a McDonald’s extra-value meal. The new referendum transfers over $15 million dollars over 8 years from taxpayers (over half of whom are in the low to moderate income level) to the school to cover pay and benefits, a new program, and some operating expenses.

-

- The superintendent has also stated that closing a school is not a viable option. Is this belief supported by the school board? What is the cost to the taxpayer of this decision? Is the cost acceptable to the taxpayers? Are taxpayers aware of the trade-offs?

Spin on taxes. The tax rate on the expiring (2023) referendum is 8 cents. The rate on the new referendum is 12 cents. The “spin” is the “increase” is “only” 4 cents. The state requires a factual statement on the language that only considers the proposed new rate of 12 cents. The fact: “The average property tax increase paid to the school corporation per year will increase by 33.91% for residences and 20.91% on business property.”

- Property taxes and increases in assessed values. When property taxes are increased, are the schools receiving additional revenue?

State Funding Policy. Regarding teacher pay, a premise is that State education policy inadequately funds teacher salaries for some districts. (The state has 291 school districts, and relatively few (14 in 2022) have opted for a referendum. Since 2009, the number of operating referendums ranged from 5 to 20. (Source: Department Local Government Finance (DLGF).

Politics and State Policy. The local teachers union, previous superintendent, and school board members signed a resolution in 2021 that challenged Indiana’s Education Choice Policy. Their position is in alignment with the controversial and political left-learning National Education Association which also has endorsed a policy opposing the increases in funding of vouchers that provide parents with a choice in their children’s education. Despite the opposition by many groups throughout the state, the budget bill containing the school voucher language and Education Savings Accounts (ESA) passed the House 96-2 and the Senate 46-3.

-

- Motivation. Since the school leadership is opposed to State funding policies, is their motivation for the referendum driven more by political considerations or financial ones?

Salary Study. On the pay issue regarding teacher salaries, in 2018, the county council with the support of the IU Kelly School of Business, developed a “comprehensive analysis and report” on staffing, pay, and benefits of county employees compared with other counties of our size. This led to some incremental changes. A similar analysis and report regarding county teacher pay and benefits would help justify appropriate action.

-

- In 2022, the Sheriff’s office with the support of the county council developed a study that demonstrated that with the required investment in officer training and turnover, higher salaries would result in more benefits than costs. The council approved the salary increases.

Declining Student Enrollment and State Funding. Further, student enrollment has been declining since 2009. Demographics and population projections indicate that this trend is unlikely to be reversed. Are taxpayers being asked to support more staffing and schools that are or will be needed? If so, this needs to be disclosed so taxpayers can factor this into their decision.

Decision-making Process – Court Case. Critical thinking involves being able to make a good argument free of fallacies, and defend it by providing credible counter-arguments. The process is equivalent to a civil case. An argument is made by both sides (pro and con), facts and evidence are presented, experts and witnesses are questioned, and a jury (voter) is then asked to make a decision. In this case, citizens received only a one-sided argument and are asked to vote Yes or No.

Positions – School Board Candidates. For those candidates supporting the new tax, What is their analysis of the “specific” information that was used by the school board to justify their unanimous vote to put the referendum on the Nov ballot? The information on the school website was posted about 2 months after the vote by the school board.

-

- Voting YES. Supporting the Referendum (voted to approve as members of the school board): Carol Bowden (Dist 1), Vicki Harden (Dist 2). Stephanie Kritzer (running for commissioner (D).

- Candidate Kathryn D. Lane (Dist. 2) and Kevin McCracken (Dist. 3), Jenise Bohbrink (Dist. 2 have identified their support for the referendum.

- Voting NO for “This year” Kevin Patrick (Dist. 1) – His statement on his FB Page

- “I am a No. Given that we have 1 year of funding left with the current 2016 referendum. I believe that is enough time and funding for any new board members to become familiar with the schools operation so that an informed plan can be put in place and strike the right balance for successful education of the kids and the operation of the school. Should there be a need for additional funding, a new referendum can be placed on the 2024 ballot and more time can be taken to share what the need(s) are, along with more details on where/how the funding will be allocated and used.”

- Position Unknown: Edward Wojdyla (Dist. 3). Mark Smith (“I will not place a burde on the taxpayers of Brown County”)

- Voting YES. Supporting the Referendum (voted to approve as members of the school board): Carol Bowden (Dist 1), Vicki Harden (Dist 2). Stephanie Kritzer (running for commissioner (D).

The Brown County Democrat newspaper avoided asking the candidates their position on the referendum. Election Guide: School Board Q&A.

Outside Funding – Political Action Committee (PAC). The Referendum campaign is receiving funding from the Brown County Educator’s Association (BCEA). “The Brown County Educators Association (BCEA) is a professional association organized to support the educators of Brown County Schools. The Indiana Political Action Committee for Education (I-PACE) is the statewide political organization for ISTA. Acting on behalf of I-PACE, the members of BCEA and the L-PAC endorse candidates for local elections.” (Ref: BC Democrat, Oct 26, 2022 advertisement).

The Indiana State Teachers Association (ISTA) is aligned with the National Education Association (NEA). NEA advocates for many policies associated with the ideology of Democrats including covid related policies, social justice, and the divisive and polarizing Critical Race Theory (CRT). NEA also opposes providing parents with school choices that can be funded with vouchers.

The BCEA (local union), the previous superintendent, and the School Board signed a resolution opposing education savings accounts and voucher expansion for private schools in Indiana in 2021.

-

- Brown County BCEA, Superintendant, School Board – Opposing ESAs and Vouchers

- Reading and mathematics scores decline during COVID-19 pandemic – National Assessment of Educational Progress

- CNN Student test scores plummeted in math and reading after the pandemic, new assessment finds

A delay of a year of a new tax increase should provide sufficient time to make a compelling case (if possible) in these economically challenging times. With the increase in inflation, gas, food, utilities, and overall cost of living, taxpayers should expect information that they can use to make a more informed decision which can lead to community buy-in and support.

Taxes. The new school operating referendum is projected to result in new property taxes that will generate over $15 million dollars over an 8-year period. The proposed tax “rate” is a 50% increase (from 8 to 12 cents) over the expiring referendum that was passed in 2016. Documents approved by the Department of Local Government Finance (DLGF) identify that “The average property tax increase paid to the school corporation (when the new rate is applied) per year will increase by 33.91% for residences and 20.91% on business property.”

-

- The Schools “Spending Plan” accepted by the DLGF

- Estimated annual revenue and expenditure: $1,892,512

- Salaries, benefits, programs: $1,419,512

- Birth to Five: $157,709 (A new program).

- Career Resource Center (CRC): $157,709

- OperatingFund: $157,709

- Estimated annual revenue and expenditure: $1,892,512

- The Schools “Spending Plan” accepted by the DLGF

Birth to Five. The Brown County Community Foundation (BCCF) along with the school, has been the advocate for this program. They asked for $195,000 from the county (status unknown) to help fund this program and also identified the request for another $157,709 as part of referendum funding. This is likely just a start.

-

- Responsibility? Typically, daycare and pre-k education costs are the responsibility of the parents and the private sector. Help can be provided by the non-profit sector (including Community Foundations and Churches), and individual donations.

- Government Role? The Birth to Five program touches on the political area supported by the “more government is better” contingent. The Obama Administration introduced the “Cradle-to-Grave” concept in the video – The Life of Julia. The concept was not well received at the time.

The Department of Local Government Finance (DLGF) has identified that relatively few (14 in 2022) of the 291 school districts in Indiana opt for an operating referendum. Brown County Schools may be unique in that there has been a systemic decline in enrollments since 2009. This fact reduces available funding for staff and programs necessitating more budget reductions than may be desired.

Additional Information:

Facebook Post (shared this post) on the topic at Brown County Matters. My reply to a comment where it was stated I was “over-thinking” the issue:

-

- Disagree. A “NO Vote” by the community this year could result in more benefits than costs. Especially, if it was followed up with the desire and commitment to make a thorough and balanced argument (better process) that would lead a “jury” (the voters) to to make a more informed decision on the merits of the argument devoid of fallacies.

- The superintendent’s statement that the tax increase is only the equivalent in the cost of an “extra value meal” is inaccurate, misleading, and disrespectful to the community. It is also a good indication of a very weak argument and reflects an inadequate decision-making process. A stronger argument may have led people to arrive at this conclusion on their own.

- The decision-making process is more important than cost. Critical thinking is the process of making a good argument, addressing the counter-arguments, and avoiding fallacies. No overthinking is needed- just some basic logic, reason, and common sense.

- Appealing to emotion, relying on surrogates to support your case, “because we said so” or “others are doing it” are among the fallacies as is attacking the critics of the referendum (the messenger) as opposed to the message. An incomplete argument can lead to divisiveness and can be polarizing.

Sept 29, 2022. ELECTION GUIDE: School board Q&A – Candidates were not asked about their position on the referendum.

-

- Post of the article at Brown County Matters

- Current School Board Members on the ballot that approved the Referendum: Carol Bowden (Dist 1), Vicki Harden (Dist 2). Stephanie Kritzer (running for commissioner (D).

- Voting Yes. Jenise Bohbrink (Dist. 2): Kathryn D. Lane (Dist. 2), Kevin McCracken (Dist 3)

- Voting No for this year – Kevin Patrick (Dist. 1)

- Position Unknown: Edward Wojdyla (Dist. 3

Sept 29, 2022. ELECTION GUIDE: What your school referendum vote means, Brown County Democrat.

Aug 12, 2022. School Board – Opposing ESAs and Vouchers

Aug 11, 2022. 2022 School Referendum – Supporting Documentation

-

- Sep 14, 2022. Post shared on the Facebook group – Brown County Matters.

July 31, 2022. Critical Race Theory (CRT), Diversity Equity Inclusion (DEI)/Equity Inclusion, and Environmental, Social, and Governance (ESG), are among the many controversial initiatives dividing the country. CRT, DEI, EI, ESG

-

- Context: The local Brown County teachers union is supported by the Indiana State Teachers Association (ISTA). ISTA is aligned with the National Education Association (NEA). The NEA has been an advocate of many controversial policies including vaccines, masks, critical race theory (CRT), parental involvement in curriculum, and opposing vouchers. In some school districts in the country, CRT is being applied through DEI programs.

- Context: The local Brown County teachers union is supported by the Indiana State Teachers Association (ISTA). ISTA is aligned with the National Education Association (NEA). The NEA has been an advocate of many controversial policies including vaccines, masks, critical race theory (CRT), parental involvement in curriculum, and opposing vouchers. In some school districts in the country, CRT is being applied through DEI programs.

America’s Founding Principles

Updated Oct 8, 2022

Updated Oct 8, 2022

The Brown County League of Women Voters endorsed a policy that endorsed a belief “that America is a nation founded on racism …”

My response:

Humans are imperfect. Racism as does other forms of bigotry has always existed to include at the time of our emergence as a country. Slavery has plagued human civilization, exists today, and has been perpetuated within races. The foundation of America’s system of government was influenced by Judeo-Christian principles – not “racism.” Our founders created a system of government that could be “continually improved” in pursuit of “a more perfect union.”

The term “perfect” originates in the Bible – we are all God’s creation regardless of skin color, ethnicity, and gender. Thus the founding principles: “We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness…”

The divisive actions from the elites (oligarchs) and those on the farther left are being influenced by Marxist philosophies. Marx credits Lucifer for his inspiration in strategies to divide people by race, age, ethnicity, gender, and economic class.

Our founders designed the first system in the history of the world that decentralized and balanced power and made “We the People” top management. The actions from the elites and far-left have been relentless in wanting to interpret the Constitution any way they see fit to align with their aims. These aims include the desire to shift power from the many to the few which has been a consistent pattern throughout history that never ends well and leads to a hell on earth – 100 million deaths in the 20th century.

The state of the union under this current administration is a case in point regarding the abuse of power and will most likely, only get worse. Higher inflation, unsecured (open) borders, energy prices (gas, electric), food prices, crime, threats of nuclear war, weaponization of the DOJ and FBI, election integrity, and framing your political opponents as enemies of the state to name a few.

-

- Franklin Graham: Biden speech an attack on ‘freedom-loving Americans’ ‘This is just further dividing our nation’

- The most effective response to the challenges is through non-violence: Martin Luther King, Jr.’s Pledge of Nonviolence: 1. Meditate daily on the teachings and life of Jesus.

2. Remember always that the non-violent movement seeks justice and reconciliation—not victory. 3. Walk and talk in the manner of love, for God is love. 4. Pray daily to be used by God in order that all men might be free. 5. Sacrifice personal wishes in order that all men might be free.6. Observe with both friend and foe the ordinary rules of courtesy.

7. Seek to perform regular service for others and for the world. 8. Refrain from the violence of fist, tongue, or heart. 9. Strive to be in good spiritual and bodily health.

10. Follow the directions of the movement and of the captain on a demonstration.

I got involved in the development of the Brown County Leader Network to help support a secular, non-secular, and “systemic” approach to improvements at the local level. The decision-making process is an example of an outline for identifying the scope and extent of a problem that supports a solution.

The context for my reply to the Leagues’ positions (which increase variation) is provided on my website and in my book.

Commissioner Meeting Notes, Oct 5, 2022

Commissioner Meeting Notes, Oct 5, 2022.

Commissioner Meeting Agenda with Notes – Oct 5 2022

Suggestion. PRAYER. Commissioner Pittman leads off the meetings with a Chrisitan-based prayer. Suggest the prayer also ask for specific guidance to support and improve the decision-making process. This would be supported by identifying all the stakeholders affected by the decision, their needs, expectations, and feedback required to validate that the change results in an improvement.

-

- Methods available for supporting process and fact-based decision making is available through the BrownCountyLeaderNetwork.com.

COMMISSIONER MEETING TIMES. The meeting time for the second commissioner meeting of the month has been moved back to 2:00 p.m vice 6:00 pm for the rest of the year to accommodate Commissioner Biddle’s medical appointments and treatments.

(Before Covid, the first meeting was in the morning (9:00?) and the second in the evening (6:00) to accommodate the public). The morning meeting was “suppose to” just cover admin topics. The evening meeting was for issues that required a vote and allow for input and questions by the citizens.

INDIAN HILL ROAD CROSSING – Allowing pedestrian traffic for accessing the Tecumseh Trail (see link below for more info). It has become more apparent that Commissioner Biddle with the support of the Railroad, was and is the county advocate for closing the railroad crossing at Indiana Hill Road and preventing pedestrian access to the trail. There is no documented analysis that justifies the decision. The other two commissioners typically just go along with her proposals without any discussion or debate. Their terms end in 2024.

Commissioners minutes 10-5-22 – prepared by the Auditor’s Office

AUDIO – Discussion Begins at the 40:40 mark

Commissioner Biddle has now identified another alternative for accessing the trail. At past meetings, Jerry Pittman expressed his support for allowing for a pedestrian crossing at Indian Hill Rd and is now supporting the new alternative with little justification for the change. Commissioners were vague on the conditions that would make this alternative route not viable.

The alternate (detour) route was identified by the Hoosier Hiker Council. This group has never presented any information at a council meeting. This route does include a RR crossing at 45 that INDOT can ensure meets standards. In contrast, the information along with supporting and documented detail that was provided at several previous meetings by the Knobstone Hiking Trail Association (KHTA) was ignored.

Hoosier Hiker’s Council. – Tecumseh Trail Re-Route. Note that the reroute involves a one-mile walk on State Road 45 from West Lost Branch Road to the Sycamore Land Trust parking lot for Trevlac Bluffs. SR 45 is a busy highway with little to no shoulder, so walk at your own risk or get a shuttle.

Commissioner Biddle’s explanations for advocacy of the new route included inaccurate information not supported with any references, misstatements, and overstatements. After several years (6+) of attending commissioner meetings, I have learned not to take any statements made at these meetings at face value. The Democrat paper typically reports on “what was said” but not on the accuracy of the statements. Reporters also tend to avoid controversy.

Commissioner Biddle identified at the “beginning” of the meeting that “the commissioners chose a new path.” This decision did not arrive from a public meeting. I asked the commissioners to document the facts associated with this new decision and provide to the public. Jerry Pittman believed this was not necessary – that the audio of the meeting and minutes was sufficient. Minutes have not typically been posted on the county website.

ROADS and BRIDGES. Mike Magnor updated his plan that covers 2021-2026 and provided feedback on what has been accomplished. This will be available at their website.

National Security Threats?

Sept 23, 2022. Conservatives have become the enemy. Exclusive: Patrice Lewis warns left’s gaslighting, projection setting the stage for ‘something big’

-

- The ‘MAGA Republican’ Smear Is About Turning Democrats’ Political Opponents Into The Government’s Enemy

- History is replete with examples of what happens when one group loses its humanity and begins committing atrocities against others. The left’s constant and extreme examples of gaslighting and projection are setting the stage for something big. You’ve been warned.

Oct 2, 2022. Memo to Christians: Here’s what’s REALLY at stake in midterm elections David Kupelian de-codes Joe Biden’s bizarre rants, warnings, lies and threats.

-

- Of course, the key to de-coding Biden’s dire warnings about the “greatest threats to America” is to understand that he was engaging in a mirror-perfect case of political projection: Every single evil that Biden ascribed to “MAGA Republicans” – the Left’s new name for America’s vast center-right middle class, literally the nation’s backbone – is actually true of today’s Democratic Party and its unhinged supporters.

Chronology

March 17, 2021 “Unclassified Summary of Assessment on Domestic Violent Extremism (DVE)” UnclassSummaryofDVEAssessment-17MAR21

-

- Enduring DVE motivations pertaining to biases against minority populations and

perceived government overreach will almost certainly continue to drive DVE radicalization and mobilization to violence. Newer sociopolitical developments—such as narratives of fraud in the recent general election, the emboldening impact of the violent breach of the US Capitol, conditions related to the COVID-19 pandemic,

and conspiracy theories promoting violence—will almost certainly spur some DVEs to try to engage in violence this year

- Enduring DVE motivations pertaining to biases against minority populations and

June 17, 2021. The First U.S. National Strategy for Countering Domestic Terrorism . On June 15, 2021, the Biden administration released the United States’ first-ever National Strategy for Countering Domestic Terrorism, which culminated the 100-day review of U.S. government efforts to respond to domestic extremism that President Biden ordered in January.

Sep 9, 2021. RealClearInvestigations’ Jan. 6-BLM Riots Comparison

-

- RealClearInvestigations has developed the comparison database below allowing readers to draw their own conclusions — including the all-but-forgotten riot in Washington on Inauguration Day 2017, as protesters challenged Trump’s election and legitimacy.

- The summer 2020 riots resulted in some 15 times more injured police officers, 19 times as many arrests, and estimated damages in dollar terms up to 740 times more costly than those of the Capitol riot.

Oct 31, 2021. The January 6 Insurrection Hoax By Roger Kimball

-

- Notwithstanding all the hysterical rhetoric surrounding the events of January 6, 2021, two critical things stand out. The first is that what happened was much more hoax than insurrection. In fact, in my judgment, it wasn’t an insurrection at all.

- An “insurrection,” as the dictionary will tell you, is a violent uprising against a government or other established authority. Unlike the violent riots that swept the country in the summer of 2020—riots that caused some $2 billion in property damage and claimed more than 20 lives—the January 6 protest at the Capitol lasted a few hours, caused minimal damage, and the only person directly killed was an unarmed female Trump supporter who was shot by a Capitol Hill Police officer. It was, as Tucker Carlson said shortly after the event, a political protest that “got out of hand.”