Economic Development (eco-devo)

“The Indiana Economic Development Corporation (IEDC) is a shadow government.“ – Micah Beckwith

Note: Brown County has not had to entice residential and commercial development through tax abatements and Tax Increment Financing (TIF) Districts. Hard Truth Hills is a recent example. Local investors also acquired and developed the properties sold by the late Andy Rogers, creating jobs and increasing the tax base.

Our mission is to marshal the best thought on governmental, economic and educational issues at the state and municipal levels. We seek to accomplish this in ways that:

-

- Exalt the truths of the Declaration of Independence, especially as they apply to the interrelated freedoms of religion, property and speech.

- Emphasize the primacy of the individual in addressing public concerns.

- Recognize that equality of opportunity is sacrificed in pursuit of equality of results.

-

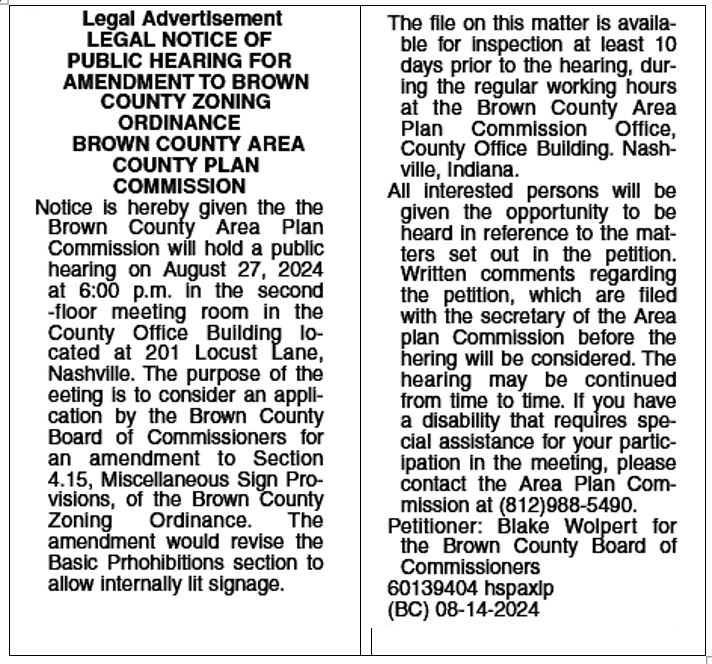

- Indiana law now makes clear that TIF is intended to fund infrastructure to promote development that would not occur but for the added infrastructure financed by the TIF revenues. Evidence that the development would not happen but for the establishment of the TIF district must be presented before the TIF district is approved. TIF is not meant as a source of revenue for responding to ongoing development nor as a substitute for other sources of infrastructure funding.

FOR SEVERAL YEARS NOW I have searched for the perfect apothegm or story to describe Indiana’s economic-development policies — you know, the ones that build stadiums and mixed-use apartment complexes, renovate entertainment and shopping districts and such, all promising growth by shifting other peoples money around with tax-secured bonds, tax increment financing, grants and rebates.

See if you can guess which best fits a typical municipal economic-development group.

-

- The Creative Generation — This is the pioneering group that generates new ideas, art and innovations, laying the foundation for the community.

- The Mimic Generation — The subsequent generation follows in the footsteps of the creative generation, replicating and imitating its achievements but not producing anything radically new or original.

- The Failed Generation — The final generation is unable to sustain the vitality of the first or false optimism of the second, leading to eventual fiscal collapse.

Congratulations, you guessed right. It is the mimic generation that goes through the motions of creating economic growth but without innovation or productivity or any market test. The next generation, if Spengler is to be believed, will be the failed generation that must pay for all the notes and bonds on those grandiose projects that never fulfilled their promise.

IT WAS AN OUTRAGEOUS admission: Officials do not know the exact cost of the subsidized Lucas Oil stadium, specifically that part assigned to the retractable roof.

It was a rare glimpse into how eco-devo is done — behind closed doors, using other people’s money, ostensibly for a popular cause.

The conclusion: “Cross-sectional studies comparing cities with teams to similar cities without teams find no evidence of extra economic growth or income associated with a team. Other studies that tracked cities over time as they gained new teams also came up empty: if anything, a new franchise can act as a slight drag on economic growth.”

AN ELEPHANT HAS ENTERED THE ROOM of Indiana’s economic-development officialdom. Nobody wants to talk about the growing amount of research challenging its policy formula. It costs a lot and it doesn’t seem to work. An adjunct scholar of the Indiana Policy Review last month described it in the inverse. He told a group of Indiana businessmen and Read the full article…

-

- An adjunct scholar of the Indiana Policy Review last month described it in the inverse. He told a group of Indiana businessmen and opinion leaders they would be better off without any official economic-development effort whatsoever. Rather than provide an economic advantage over competing cities, he says it has merely facilitated a “race to the bottom.” (1)

“Hotel Coming to Site of Old VCSC Building” — Terre Haute Tribune, July 26, 2024 by Ryan Cummins I write to you about another in a long list of eco-devo (economic development) scams, a particularly obscene one. That it is presented as a straight news story in a humdrum manner is even more disheartening. But then, I don’t expect Read the full article…

By David Penticuff Our “Haves” are again turning to our “Have Nots” for monetary help through tax increment financing. Central Indiana Ethanol (CIE) is asking my city to expand its Tax Increment Financing (TIF) district to include the former Omnisource property, which CIE purchased last year, in order to finance a project already underway at Read the full article…

“Something worth doing is worth measuring.” — Dr. John Crawford, Fort Wayne City Council by Ken Davidson Over the course of the past three years, obtaining information on Tax Increment Financing (TIF) districts has been made difficult and in some ways impossible. In 2016, shortly after articles appeared in the quarterly Indiana Policy Review, the Read the full article…

The following is based on comments made at a foundation luncheon April 12, 2018, in Fort Wayne. by Barry Keating, Ph.D. Jerry Brown was elected governor of California in 1974 and again in 1978 before busying himself as mayor of Oakland. Californians in 2010 apparently wanted to return to the days of “Governor Moonbeam,” as Read the full article…

Market versus Government Failure

Economists argue that “market failure” is the main reason for the government; they argue that private markets do not build roads, provide clean water, eliminate sewage and enforce the law. We need government to do these things. These economists are correct. Each of these appropriate roles for the government was detailed long ago at Wabash College in Crawfordsville by Dr. Milton Friedman when he presented a set of talks later published as “Capitalism & Freedom.” Friedman listed just three areas of appropriate government action:

-

- The government needs to act as a rule-maker and enforcer;

- The government should provide public goods (e.g., roads, bridges);

- Finally, the government should sometimes operate paternally (e.g., for children who cannot fare for themselves).

These three areas Friedman detailed were appropriate for government action because markets had no incentive to provide these goods and services. It was the government’s duty to step in and see to their provision. But the government, according to this argument, should not provide goods and services whenever there is an incentive for the market to act.

by Fred McCarthy We found it interesting that the local Chamber of Commerce, which in theory represents the business community, has volunteered to help a governmental agency more easily increase the tax burden on the business community. It comes as no surprise for in recent years we do not recall the Chamber ever questioning tax Read the full article…

by David Penticuff Fifty years ago the great character actor Strother Martin uttered what could be the epitaph for the relationship of my city council and the city administration. It was in the movie “Cool Hand Luke.” Martin, who played a prison warden, knocked prisoner Paul Newman, wearing chains, down a tall hill after Newman’s character Read the full article…

by Craig Ladwig There were howls of anguish when a proposal was made to change municipal bidding practices in Indiana to limit the influence of campaign donations. One mayor called the plan disrespectful. A development official took umbrage that anyone would use the word “corruption” in connection with his city. Today, though, David Penticuff of the Read the full article…

by David Penticuff Loren Matthes, a partner at Umbaugh and Associates, spoke at a Wednesday at our local council meeting about the financial predicament of our city. In calm fashion, for the first time in a year and a half of working on our city’s budget problems, an Umbaugh official spoke in public about our Read the full article…

by Martina Webster Hoosiers, we just paid our fall property tax installments back in November. Do you know how they were calculated? Where did your government come up with that number? And are property taxes really worse than the alternatives? The first thing you may not know is your home is assessed based on its Read the full article…

by Martina Webster In my county we have an issue with tax increment financing (TIF). As of 2014, almost 20 percent of our property taxes go into multiple TIF funds instead of the appropriate taxing units. Our school districts, libraries and general funds lose millions every year to the specially carved out TIF districts, which Read the full article…

by Craig Ladwig A group of researchers at Ball State University last week released another critical assessments of Tax Increment Financing (TIF). The authors, Dr. Michael Hicks, Dr. Dagney Faulk and Srikant Devaraj, join Tom Heller, writing in the current issue of The Indiana Policy Review, in casting doubt on this enigmatic tax policy. The Read the full article…

by Fred McCarthy They say insanity is doing the same thing time after time and expecting different results. And citizen ignorance plus lethargy adds to the insanity by accepting rosy financial fantasies and outright lies. A recent front-page story in the Indianapolis Star, with artwork, is headed “A project expands.” It concerns, of course, another Read the full article…

The foundation’s white papers are intended to make scholarly research on Indiana issues more widely available to policy analysts and researchers. White papers represent research in progress and are published to invite comment and discussion as preparation for their submission to academic journals and other professional publications. The authors are solely responsible for the content Read the full article…

(For the use of the membership only) by Greg Walker For decades, Indiana has utilized tax increment financing (TIF), an instrument by which future property-tax revenue is captured to pledge for borrowed funds for capital investment. It nonetheless remains controversial. We need to ask why. Debt, or leverage, is a simple idea, and businesses employ this decision Read the full article…

DRAFT COPY FOR MEMBERS ONLY: NOT FOR PUBLICATION, QUOTATION OR DUPLICATION Editors: The author earned his bachelors in economics at the Wharton School and a masters in regional science, both from the University of Pennsylvania. Prior to his move to Indiana, he was principal and founder of regional analytic sciences in Seattle, Washington. Heller’s Read the full article…

by Maryann O. Keating, Ph.D The Wall Street Journal recently listed penthouses available for sale at $2.1 million or more at Philadelphia’s “most prestigious address.” Units were designed by an award-winning architect and are located in a fully staffed building with five-star concierge services. Each sale includes a 10-year tax abatement. In March of this Read the full article…

by Thomas Heller Tax Increment Financing (TIF), a widely misunderstood economic-development tool in Indiana, operates something like a bank. TIF districts make investments in local public improvements (roads, etc.) hoping to attract follow-on investment from private companies. Often these improvements are financed by borrowing — that is, issuing bonds to be paid off by the Read the full article…

Well, he’s back. Jerry Brown, after a stint as mayor of the City of Oakland, is once again governor of California. This time, however, the ultra-liberal governor has something to teach Indiana. For this is a different Jerry Brown; now he’s attempting to cut $1.7 billion from the state budget to correct a deficit that Read the full article…

by David Penticuff A councilman took our newspaper to task this week for criticizing the council on its apparent lack of curiosity regarding the granting of property-tax abatements. It turns out we were wrong in that regard. Council members have a lot of information about the tax abatements they vote to grant. They just don’t Read the full article…

by Barry Keating, Ph.D. The tallest and most prominent building in South Bend is the Chase Tower. The tower is also known for inoperable elevators and a crumbling façade; the occupancy rate is about 50 percent. The Summit Club, once located on the tower’s top floor, was considered the most elite restaurant in town. Now Read the full article…

by Barry Keating, Ph.D. Edinburgh isa town in Bartholomew County. It is part of the Columbus, Indiana, metropolitan statistical area. An astounding event took place in Edinburgh this past month: A firm engaged in building a new plant failed to ask for a tax abatement! Such behavior is unusual; new businesses of every variety routinely request tax Read the full article…