This post at Brown County Matters.

Context. Rich Stanley wrote a letter in the Democrat (Stanley, 9/17/2024) calling for a change in the leadership of the local Republican Party led by Mark Bowman. A response to Rich’s letter was provided through a surrogate.

The Brown County Democrat declined to publish Richard’s rebuttal in its entirety to include the names of individuals who supported Rich’s response. The individuals include Clara Stanley, Greg DeLong, Dara DeLong, Vivian Wolf, Michael Painter, Charles F. Shaw, Jeanne Shaw, Jacob Adams, Amie Yoder, Charlene Marsh, Ben Phillips, Mercy Phillips, Daniel C. Huston, Holly H. Huston, Willow Snider, Ron Lawson, Jeff Marshall, Joy Martin.

Rich’s letter in its entirety is provided below.

LETTER: Richard Stanley: Response to Paul Hazelwood’s October 1, 2024, letter to the Editor.

There are a number things about Paul’s letter (Sep 17, 2024) that I feel should be addressed, and the least important of those issues is Paul’s question of “Who is Rich?” I don’t fault Paul for not being sure who I am because I am more commonly known in the county as “Clara’s husband”. But besides being less well-known than my wife, I am a woodworker, a horseman, a hunter, a gardener and a churchgoer. What I mean by that is that in some way or another, I am no different than most people in Brown County. And one thing you are most certainly wrong about Paul is that I am not a RINO. I have never once in my entire life voted for a Democrat – or even an independent for that matter, and I do not foresee myself ever voting for a Democrat or an independent.

But let’s talk more about your sloppy RINO accusations. At the local level here in Brown County, what does that term really even mean? Definitionally, it refers to someone who pretends to be a Republican but who in reality does not support core Republican values. So, in order to use that term correctly, we would need to know what the core values of the Republican Party are in Brown County. And yet, Paul, you failed in your letter to directly explain what the core values of the Republican party are in Brown County. However, your letter does offer some clues about what you appear to believe are the core values of Brown County Republicans.

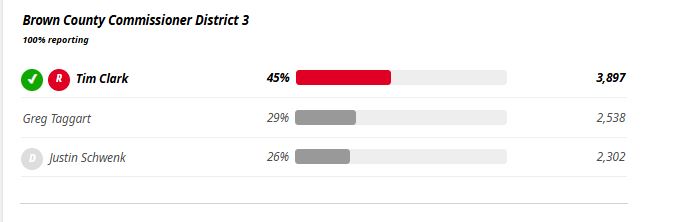

First, you seem to believe that the primary core value of Brown County Republicans is unrestrained commercialization of the county. I am just an ordinary Brown County Republican voter, but that is not what I support. I do, however, support reasonable commercialization of the county as opposed to unrestrained commercialization. And your letter completely mischaracterizes this issue. Nobody (including Tim Clark) wants to shut down tourism in the county – that’s absurd. Tourism is an important part of our county that we all appreciate. But let’s also be honest. The vast majority of residents in Brown County do not have financial interests that are tied to Brown County tourism. I don’t mean this in any negative way at all, but the number of people in Brown County who are economically impacted by tourism is a minority, not the majority. When it comes to governance in Brown County, we need to take into consideration the interests of all Brown County residents.

You also seem to believe that Brown County should be run by the few for the benefit of the few. I don’t agree with you about this either, and the Lincoln Day Dinner controversy is emblematic of this problem in Brown County. You expressly state in your letter that you approve of Mark Bowman’s exclusion of Tim Clark from that event (“Personally, I’m glad he didn’t attend.”). But what I want is open, honest and responsible governance in Brown County. Above all, that is the seminal issue of Tim Clark’s campaign. He simply wants to open up Brown County governance and get more input from the public on matters that affect all of us. That is most certainly not what Mark Bowman was doing when he excluded a Republican candidate (Tim Clark) who is the preferred candidate of a majority of the Republicans in the county.

And your support of Mark Bowman as Chairman of the Republican Party in Brown County is the height of duplicity. You accuse myself and Tim of being RINOs (which is not true), but it’s already been established that Mark actually does satisfy the definition of a RINO according to the Indiana GOP rules. (Rich Stanley, BC Democrat, 9/17/2024). If your concern was really about RINOs, you would be attacking Mark Bowman, not Tim Clark and myself.

Now, let’s talk about special interests, and I have to point out that you, Paul, are the epitome of a special interest. You pushed through the off-road vehicle ordinance that permits almost unrestricted use of off-road vehicles on Brown County roads, even though the number of Brown County residents who will actually benefit from this is exceedingly few. And you did it in such a rushed manner that the opposition had little chance to offer any input. (Rich Stanley, BC Democrat, 7/30/2024). Special interests are fundamentally undemocratic because they seek to benefit a minority while burdening the majority. I am fundamentally against this type of special interest governance, but you seem to think special interest governance is a core value of Brown County Republicans.

In your letter, you also argue that Tim Clark only won the primary against Jerry Pitman because of a smear campaign. But, your hypocrisy is shocking! First, no one intends any ill will towards Jerry, but he knows himself why he lost and it had nothing to do with a smear campaign. He lost of his own accord. And second, Republicans in Brown County want a change in the way our county is governed and that is why the majority of Republicans voted for Tim Clark over Jerry Pitman. The real smear campaign has been against Tim Clark. I have heard far too many smears against him, and every one of them is either so vague as to lack any real meaning or are outright lies and distortions. I say this to everyone. If there are county issues that you are concerned about, go talk to Tim. He does not play favorites and will talk to anyone who has good faith concerns.

Paul, you also criticize me in your letter in one way that I actually agree with. You say, “I haven’t seen [Rich] at any Republican events, county meetings or town halls.” Generally speaking, that’s somewhat true. I am coming to realize that it is a problem when very few people show up to county events like this. But, on the other hand, that is one of the key reasons why I am supporting Tim Clark. Even though this is Tim Clark’s first campaign and he has never held elected office, he has been attending every single one of these events for years. Tim Clark is very levelheaded, and I am so thankful to him for spending the amount of time that he does on county governance. Admittedly, having someone like Tim Clark in office allows someone like me to be a bit lazier than I should be.

I am not alone in believing that Brown County needs a change in our governance. Perhaps we should start by defining what the core values of Brown County Republicans actually are. The undersigned are in agreement that the following should be considered to be core values of the Republican Party in Brown County. Tim Clark represents these core values, and therefore Paul, you are wrong to call Tim Clark a RINO.

- We are against special interests.

- We are for open, honest and responsible governance.

- We are for common decency, including for those we disagree with.

- We are for fiscal responsibility.

- We are for maintaining the unique character of Brown County, which includes nature, solitude and tourism.

- We are for reasonable commercial development.

Rich Stanley, Clara Stanley, Greg DeLong, Dara DeLong, Vivian Wolf, Michael Painter, Charles F. Shaw, Jeanne Shaw, Jacob Adams, Amie Yoder, Charlene Marsh, Ben Phillips, Mercy Phillips, Daniel C. Huston, Holly H. Huston, Willow Snider, Ron Lawson, Jeff Marshall, Joy Martin.

Afterword. I would like to briefly explain why I did not publish this letter in the Brown County Democrat. When I submitted the letter to the Editor of the Brown County Democrat, Dave Stafford objected to including signatories and also to the length of the letter.

In response, I requested that the Brown County Democrat publish an alternate letter that I provided which was only a paragraph long and simply stated that I had drafted a response to Paul Hazelwood and that it would be published at independentvotersofbrowncountyin.com.

The Editor also refused to publish my alternative letter. My view is that the Brown County Democrat is seeking to minimize political debate in its newspaper, and that is yet another thing that I fundamentally disagree with. We need more public debate in Brown County, not less.

Tim Clark has inspired a movement that we desperately need in this county. In order to effectuate those changes, we need to keep up the charge against those entrenched forces who would stifle this movement.

Brown County Democrat – Policy on Letters and Guest Opinions. The new editor of the Democrat has reduced the length of articles that have been allowed previously. Clarification on the current policy on the length of letters was published in the October 22, 2024 edition of the paper. Dave Stafford: We’re setting some standard rules for letters