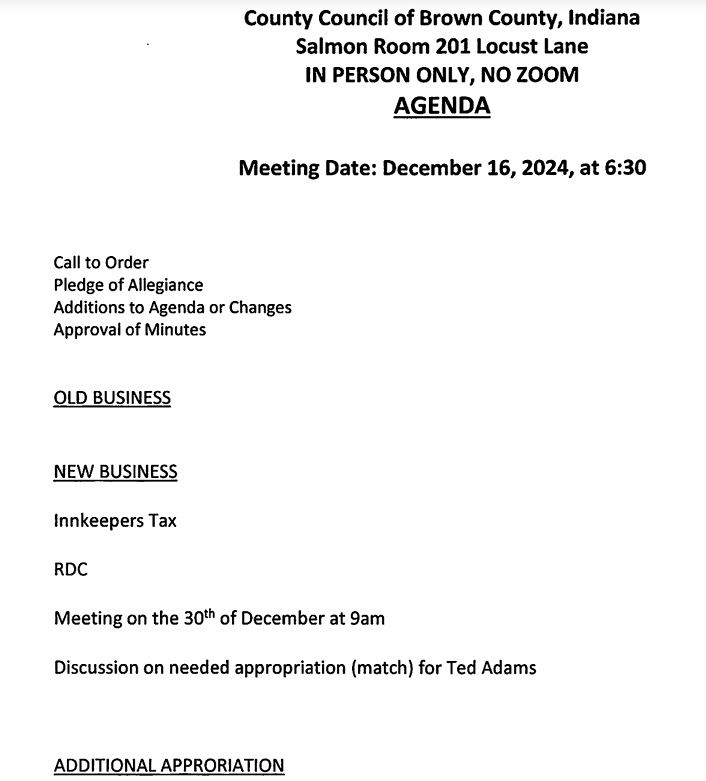

Agenda County Council December 16, 2024 (Also below)

-

- Addition to the agenda: Health Department request/discussion on personnel staffing changes and salary adjustments

-

- 00:21:30 Jim Kemp – Status of County Finances. Case for Change

- 00:34:30 Scott Rudd. New Sources of Revenue, Priorities, Pros and Cons.

FYI: The 8 Steps for Leading Change

Finance and Budgets. In the State government, this is a budget year, and the budget is developed for two years. There are indications that the new governor will be working to reduce property taxes, thus reducing revenue to the county. To make up for a shortfall, the state may be allowing counties to increase taxes to make up the deficit. Brown County is maxed out on raising income taxes and is constrained in raising property taxes due to the caps – 1% on residential and 2% on commercial.

County Financial Outlook — 2025-2026. Not looking good. Councilman Kemp projects that given the current assessment of revenues and expenses, we may have around a $700-800K budget deficit in 2025 and 2026 respectively. This does not factor in unanticipated expenses related to health insurance and unexpected capital improvement repairs and replacements. In a near worst-case scenario, deficits would have to be covered by reducing employees and benefits. A higher deficit was projected last year and a crisis averted when new revenue was discovered.

New Sources of Revenue

-

- PERF (Retirement System). The county contributes matching funds to the employee pension system, but when an employee leaves before being vested, the state retains the money. How much of this money can the county get back?

- State Park Gate Fee. This may be the first time in 20+ years that the county’s request for a gate fee at the State park may be approved. This could range from 50 cents to a dollar, which may bring in $200-350K a year. This would not apply to those with an annual pass.

- Innkeepers tax. The legislature can allow the county to raise the innkeepers’ tax from 5 to 8 percent. If so, it is then up to the county to accept or reject the increase. The council voted to support this option. An increase could bring in 700-750K a year. The priority would be public safety.

- The purpose of the innkeepers tax is to help promote tourism BUT counties have the option for how best to determine how the money can be spent. In our case, this would be defined in Chapter 14, Brown County Innkeepers Tax (IC 6-9-14-1).

- The soonest the county could receive additional funds would be Jan 2026 or July 1, 2025 if the county’s request was approved.

- BCMC – Distribution – Excess Revenue. Although not mentioned at the council meeting, Commissioners have the responsibility to determine the distribution of excess revenue from the Music Center. The current distribution is 75% to the Foundation and 25% to the county. The “Council” also influences the amount of excess revenue that may be available. The council reviews and approves the budget for how the revenue from the innkeepers’ tax can be budgeted.

Economic Development District (EDD). The county has the option to join with Monroe and Owen County to develop an EDD. This would provide the opportunity to apply for federal grants. This should make for some interesting conversations. Topic to be discussed at the next council working session.