Last updated Jan 31, 2024

Revenue from the Innkeepers Tax – History, Opportunities, Public Input

Question: With more revenue coming in from the innkeeper’s tax, is now a good opportunity for the commissioners and council to hold public meetings to ask for citizen input on how best this revenue should be invested?

Options

Innkeepers Tax Revenue – Discrepancies – Working to understand the differences. UPDATE from the Treasurer – today Jan 30, 2024, 4:30 pm.

-

- 2021 $1,221,412.15

- 2022 $1,161858.25

- 2023 $1,327512.15

-

- Innkeepers Tax Report 12-31-23 Provided by the BCMC Management Group

- 2020: $821,438.58

- 2021: $1,221,412.15

- 2022: $1,161,858.25

- 2023: $1,327,512.15

- Innkeepers Tax Revenue Trends (source: Treasurer – corrected)

- 2017: $829,687.66

- 2018: $865,890.34

- 2019: $891,179.53 (BCMC opens)

- 2020: 821,438.58 (COVID)

- 2021 $1,221,412.15

- 2022 $1,161858.25

- 2023 $1,327512.15

- Innkeepers Tax Report 12-31-23 Provided by the BCMC Management Group

By law (and Govt 101), revenue from the innkeeper’s tax is a county asset. However, a former long-serving councilman remarked that the revenue belonged to the tourism industry.

At the vote to approve the Music Center project, he stated that “It was their money.” He has since retired from the council but the attitude remains. The County Council is legally required to review and approve how these funds are spent. Unfortunately, they still take a hand-off approach and may only meet the minimum standard required by law.

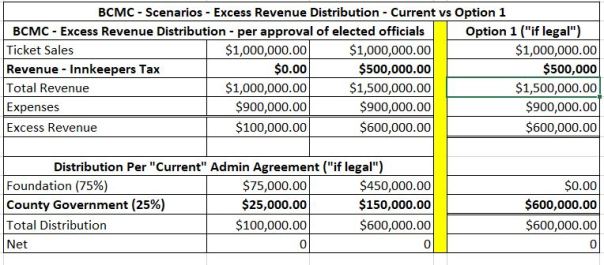

BCMC Management Board. Regarding the Music Center, a 7-member board –1 county council rep, 1 commissioner rep, and 5 unelected members determine how the revenue will be used to fund the Music Center and how excess revenue from the BCMC will be distributed. Per the current admin agreement, 75% of any excess revenue (“if legal”) will be donated to the Community Foundation and 25% to the county.

Costs of Tourism. County taxpayers are expected to pick up the cost of tourism-related expenses that include sheriff, ambulance, and emergency service to the State park, costs of crime, and accident-related expenses, and county roads. It has been estimated we get about 3 million visitors a year.

Tax Revenue. The county is primarily funded by income and property tax. The “state” is funded primarily by “”sales and income tax. The innkeeper’s tax helps generate sales tax revenue for the state. Regarding property taxes, all property has to be assessed at least once every four years. Residents’ property can be reassessed every year resulting in citizens paying higher taxes. Few if any (?) businesses are assessed yearly which can delay the payment of any additional taxes until the 5th year.

History. Brown County was eligible to start collecting Innkeeper’s tax revenue in 1984. This is a 5% tax added to the cost of an overnight stay.

Revenue from the tax must be used to promote tourism. In addition to restaurants and hotels, the revenue can be used to promote any type of tourism. In addition to general categories of tourism such as building a music venue, other categories include Nature tourism (Hiking, walking, camping); Ecotourism (Guided tours focusing on educating, summer camps, outdoor classes); Adventure tourism (biking), Agritourism, History/Heritage, Sports, and Wellness. Wikipedia also identifies about 25 niche market segments.

CVC/CVB. The law establishes a five-member Convention Visitors Commission (CVC) and allows for the establishment of a non-profit – Convention Visitors Bureau (CVB) to provide marketing services. CVC members are appointed by commissioners and the council.

The Inneepers collect the tax and the auditor and treasurer manage the funds. The CVC prepares a budget each year for how the revenue will be allocated. Historically, most if not all of the funds were given to the CVB. The law requires the County Council to “review and approve” the CVC Budget.

Accountability? However, once the revenue is transferred to the CVB, county elected officials have no oversight over how the money was spent and the results that were achieved.

Collateral. Revenue from the Innkeepers tax, with agreements from the tourism industry (CVB), was used as collateral for the loan (12.5 million) to build the Brown County Music Center (BCMC), The Music Center would be the priority for funding. In the 2024 budget, only $200,00 was budgeted for the BCMC.

More Information. Another post with links to the law and agreements. Leveraging Revenue – Innkeepers Tax

By law, revenue from the innkeeper’s tax is a county asset. However, a former long-serving councilman remarked that the revenue belonged to the tourism industry – “it was their money.” He has since retired from the council but the attitude remains. The County Council is legally required to review and approve how these funds are spent but still take a hand-off approach.

Regarding the Music Cente, a 7-member board –1 council rep, 1 commissioner rep, and 5 unelected members, determine how the revenue will be used to fund the Music Center and how excess revenue from the BCMC will be distributed. Per the current admin agreement, 75% of any excess revenue (“if legal”) will be donated to the Community Foundation and 25% returned to the county.

County taxpayers are expected to pick up the cost of tourism-related expenses that include sheriff, ambulance, and emergency service to the State park, costs of crime, and accident-related expenses, and county roads. It has been estimated we get about 3 million visitors a year.

Regarding property taxes, all property has to be assessed at least once every four years. Residential property can be reassessed every year and result in paying higher taxes, but not all businesses.

Revenue Trends (2021-2023 updated by the Treasurer Jan 24, 2023.

- 2017: $829,687.66

- 2018: $865,890.34

- 2019: $891,179.53 (BCMC opens)

- 2020: 821,438.58 (COVID)

- 2021 $1,221,412.15

- 2022 $1,161858.25

- 2023 $1,327512.15

History

Brown County started collecting Innkeeper’s tax revenue in 1984. This is a 5% tax added to the cost of an overnight stay.

Revenue from the tax must be used to promote tourism. In addition to restaurants and hotels, the revenue can be used to promote any type of tourism. In addition to general categories of tourism such as Music, other categories include Nature tourism (Hiking, walking, camping); Ecotourism (Guided tours focusing on educating, summer camps, and outdoor classes); Adventure tourism (biking), Agritourism, History/Heritage, Sports, Wellness. Wikipedia also identifies about 25 niche market segments. https://en.wikipedia.org/wiki/Tourism.

The law establishes a five-member Convention Visitors Commissioner (CVC) and allows for the establishment of a non-profit – Convention Visitors Bureau (CVB) to provide marketing services.

The Innkpeers collect the tax and the auditor and treasurer manage the funds. The CVC prepares a budget each year for how the revenue will be allocated. Hisotoralu, most if not all of the funds were given to the CVB. The law requires that the County Council review and approve the CVC Budget.

However, once the funds are transferred to the CVB, county elected officials have no oversight over how the money was spent and the results that were achieved.

Revenue from the Innkeepers tax, with agreement from the tourism industry (CVB), was used as collateral for the loan (12.5 million) to build the Brown County Music Center (BCMC) and agreements were reached that the Musci Center would be the priority for funding. In the 2024 budget, only $200,00 was budgeted for the BCMC.

My post with links to the law and agreements. Leveraging Revenue – Innkeepers Tax